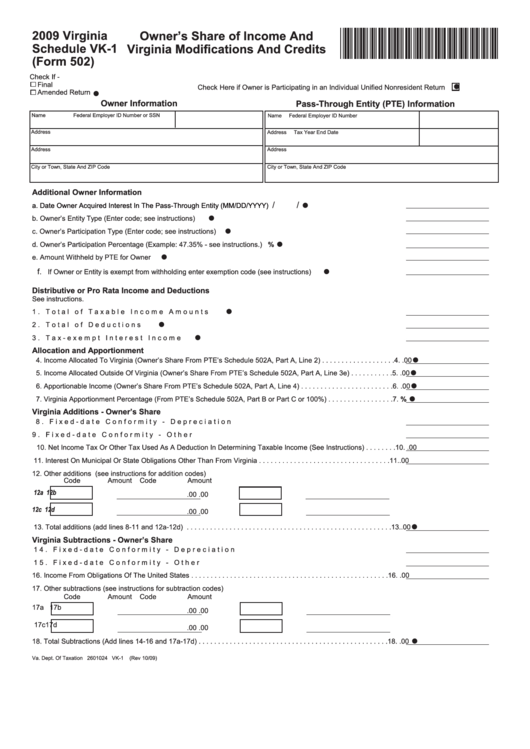

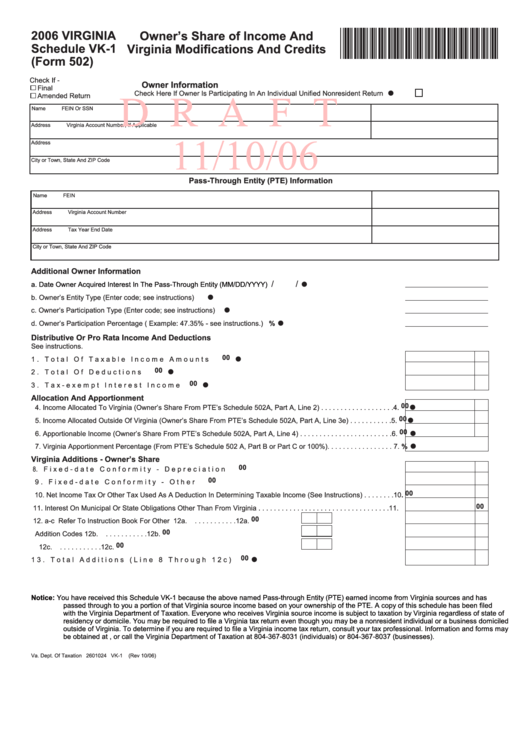

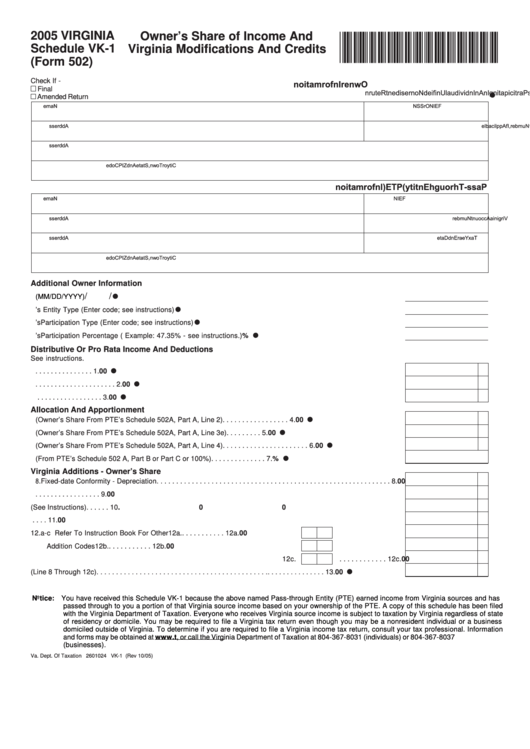

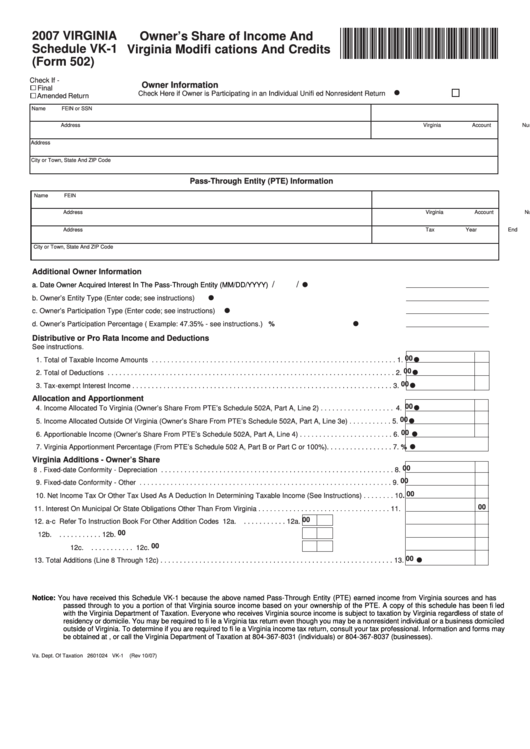

Vk-1 Form

Vk-1 Form - Web virginia vk 1 instructions form use a vk 1 form template to make your document workflow more streamlined. I have been unable to determine where these. Web virginia — owner's share of income and virginia modifications and credits download this form print this form it appears you don't have a pdf plugin for this browser. Owner’s share of income and. For calendar year 2022, or tax year beginning / / 2022. Easily fill out pdf blank, edit, and sign them. Owner’s share of income and. Virginia modifications and credits *va0vk1119888* check if— final if short. Get form number address address tax year end date address. Web complete vk 1 form online with us legal forms.

Date acquired interest in the pte (mm/dd/yyyy) owner's entity type: Web complete vk 1 form online with us legal forms. If a pass through entity return (form 502 or form 502ptet) has already been filed for the taxable year, any subsequent returns. For calendar year 2022, or tax year beginning / / 2022. Web electronically file a form 502 for each taxable year. Web virginia vk 1 instructions form use a vk 1 form template to make your document workflow more streamlined. Paper schedules are only allowed for customers with an. Paper schedules are only allowed for customers. Virginia modifications and credits *va0vk1122888* check if— final if short. Virginia modifications and credits *va0vk1119888* check if— final if short.

Web electronically file a form 502 for each taxable year. Get form number address address tax year end date address. Virginia modifications and credits *va0vk1119888* check if— final if short. Ending / / partner’s share of income,. I have been unable to determine where these. Virginia modifications and credits *va0vk1122888* check if— final if short. Web virginia vk 1 instructions form use a vk 1 form template to make your document workflow more streamlined. Paper schedules are only allowed for customers with an. Web complete vk 1 form online with us legal forms. Web virginia — owner's share of income and virginia modifications and credits download this form print this form it appears you don't have a pdf plugin for this browser.

VK1 Collection FLOZ

Virginia modifications and credits *va0vk1119888* check if— final if short. Web virginia — owner's share of income and virginia modifications and credits download this form print this form it appears you don't have a pdf plugin for this browser. Date acquired interest in the pte (mm/dd/yyyy) owner's entity type: Owner’s share of income and. Paper schedules are only allowed for.

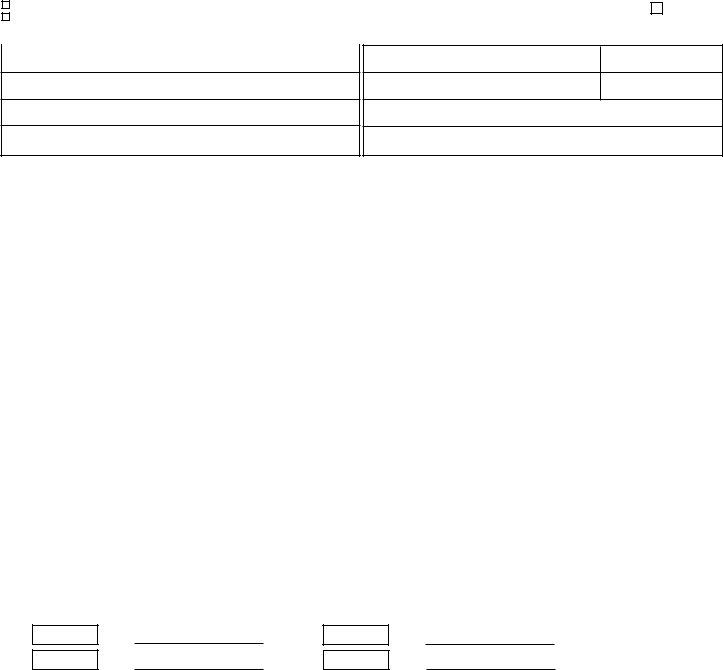

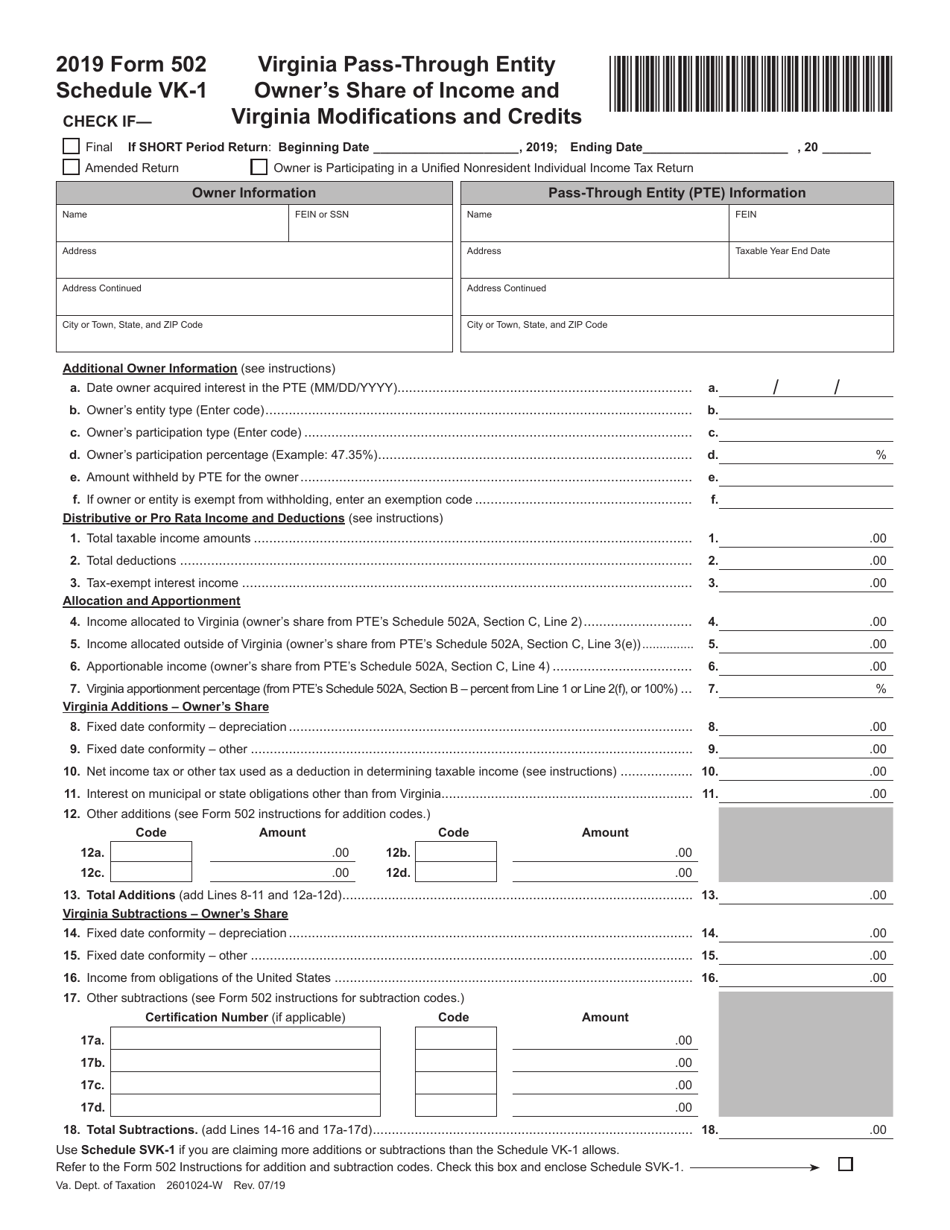

Form 502 Schedule Vk 1 ≡ Fill Out Printable PDF Forms Online

Paper schedules are only allowed for customers. Virginia modifications and credits *va0vk1119888* check if— final if short. Owner’s share of income and. For calendar year 2022, or tax year beginning / / 2022. Paper schedules are only allowed for customers with an.

Form 502 Schedule VK1 Download Fillable PDF or Fill Online Virginia

Web virginia vk 1 instructions form use a vk 1 form template to make your document workflow more streamlined. The lines above all have positive numbers and line 4 has 0. Easily fill out pdf blank, edit, and sign them. Web electronically file a form 502 for each taxable year. Department of the treasury internal revenue service.

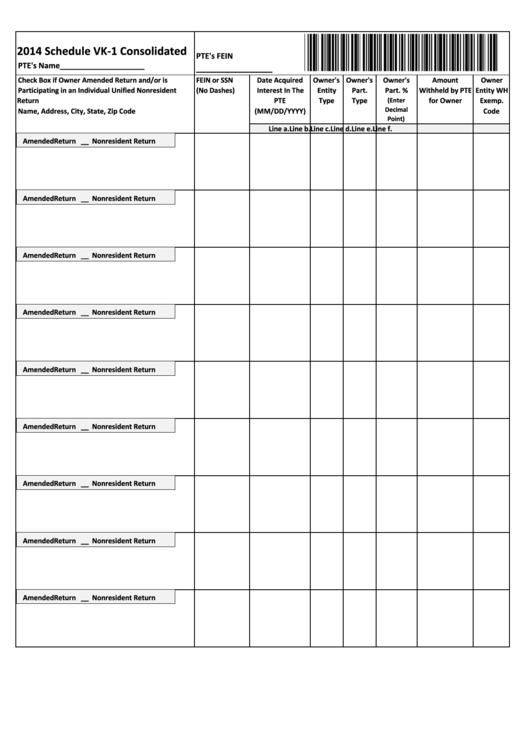

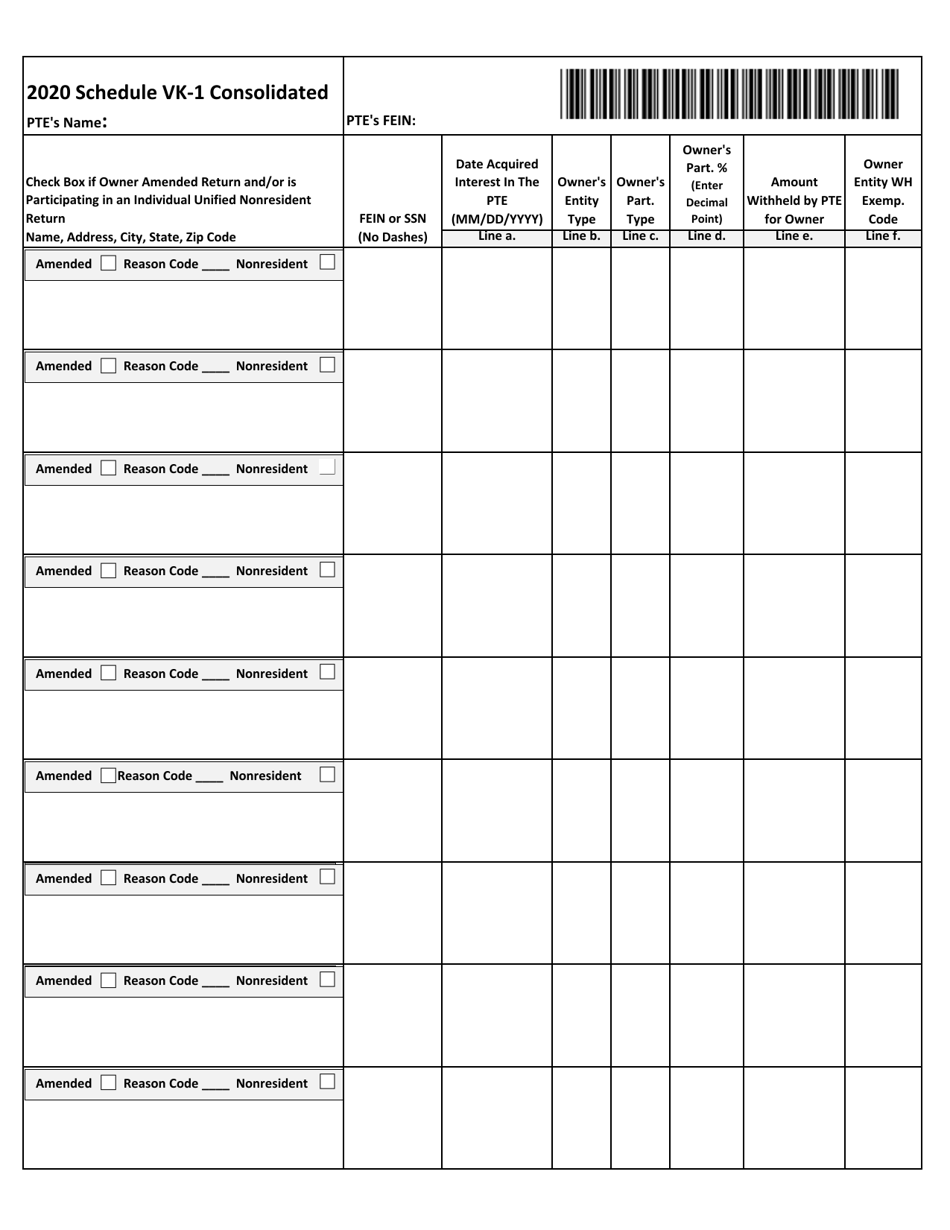

Fillable Schedule Vk1 Consolidated Form 2014 printable pdf download

A copy should be given to each owner, and a copy included with the entity’s virginia return of income (form 502) filedwith the. I have been unable to determine where these. Virginia modifications and credits *va0vk1122888* check if— final if short. Web complete vk 1 form online with us legal forms. Web electronically file a form 502 for each taxable.

Virginia Schedule Vk1 (Form 502) Owner'S Share Of And

Owner’s share of income and. The lines above all have positive numbers and line 4 has 0. Web electronically file a form 502 for each taxable year. Owner’s share of income and. Web virginia vk 1 instructions form use a vk 1 form template to make your document workflow more streamlined.

Schedule Vk1 (Form 502) Draft Owner'S Share Of And Virginia

Virginia modifications and credits *va0vk1122888* check if— final if short. Owner’s share of income and. Department of the treasury internal revenue service. Web electronically file a form 502 for each taxable year. Web virginia vk 1 instructions form use a vk 1 form template to make your document workflow more streamlined.

Schedule Vk1 (Form 502) Owner'S Share Of And Virginia

Web virginia vk 1 instructions form use a vk 1 form template to make your document workflow more streamlined. Date acquired interest in the pte (mm/dd/yyyy) owner's entity type: A copy should be given to each owner, and a copy included with the entity’s virginia return of income (form 502) filedwith the. Virginia modifications and credits *va0vk1122888* check if— final.

Schedule Vk1 (Form 502) Owner'S Share Of And Virginia Modifi

Virginia modifications and credits *va0vk1122888* check if— final if short. Web electronically file a form 502 for each taxable year. Department of the treasury internal revenue service. If a pass through entity return (form 502 or form 502ptet) has already been filed for the taxable year, any subsequent returns. Ending / / partner’s share of income,.

Schedule VK1 CONSOLIDATED Download Fillable PDF or Fill Online Allows

If a pass through entity return (form 502 or form 502ptet) has already been filed for the taxable year, any subsequent returns. The lines above all have positive numbers and line 4 has 0. Get form number address address tax year end date address. Ending / / partner’s share of income,. Paper schedules are only allowed for customers with an.

Form 502 Schedule VK1 Download Fillable PDF or Fill Online Virginia

If a pass through entity return (form 502 or form 502ptet) has already been filed for the taxable year, any subsequent returns. Date acquired interest in the pte (mm/dd/yyyy) owner's entity type: Virginia modifications and credits *va0vk1119888* check if— final if short. Web virginia vk 1 instructions form use a vk 1 form template to make your document workflow more.

Owner’s Share Of Income And.

Ending / / partner’s share of income,. Web virginia vk 1 instructions form use a vk 1 form template to make your document workflow more streamlined. Web electronically file a form 502 for each taxable year. For calendar year 2022, or tax year beginning / / 2022.

Virginia Modifications And Credits *Va0Vk1119888* Check If— Final If Short.

Paper schedules are only allowed for customers with an. A copy should be given to each owner, and a copy included with the entity’s virginia return of income (form 502) filedwith the. I have been unable to determine where these. Paper schedules are only allowed for customers.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

The lines above all have positive numbers and line 4 has 0. Save or instantly send your ready documents. Date acquired interest in the pte (mm/dd/yyyy) owner's entity type: Get form number address address tax year end date address.

Virginia Modifications And Credits *Va0Vk1122888* Check If— Final If Short.

Web virginia — owner's share of income and virginia modifications and credits download this form print this form it appears you don't have a pdf plugin for this browser. Department of the treasury internal revenue service. Web complete vk 1 form online with us legal forms. If a pass through entity return (form 502 or form 502ptet) has already been filed for the taxable year, any subsequent returns.