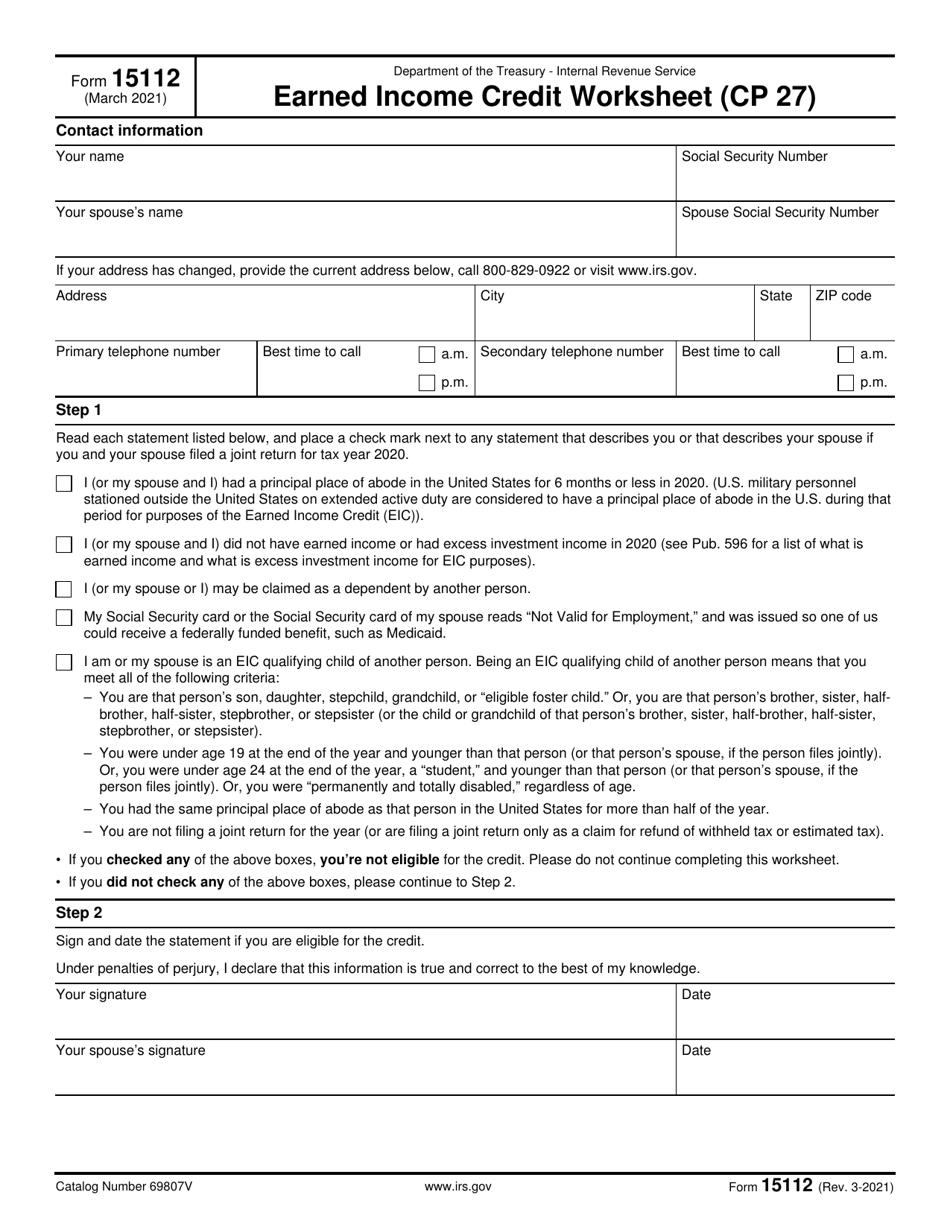

What Is A 15112 Form

What Is A 15112 Form - Web form 15112 question (eic) i received this form in the mail today and one of the questions is confusing me. Now they say to call back in 30 days. If you qualify, you can use the credit to reduce the taxes you. Web level 1 earned income credit letter from irs just received a letter from irs stating you may be eligible for a refund of up to $1502 for the earned income credit. Web posted on jul 16, 2010. If you have your eligible child (ren) entered as dependent (s) on your form 1040 page1. This is my first year filing independent so i’m confused really. Web i received a cp27 notice for the earned incom tax credit. I filled out the form 15112 earned income credit worksheet and sent march 23rd, 2022, and they received it on march. I had a principle place of.

This is my first year filing independent so i’m confused really. Web level 1 earned income credit letter from irs just received a letter from irs stating you may be eligible for a refund of up to $1502 for the earned income credit. Web irs form 15112 january 2022 is a document produced by the u.s. Considering that the irs had this issue. A number (such as 1, 2, 100 or 253 ) used to indicate quantity but not order. Web form 15112 is for the earned income tax credit, not the child tax credit. Web posted on jul 16, 2010. Web help notices and letters understanding your cp09 notice what this notice is about you may be eligible for the earned income credit but didn't claim it on your tax return. This form came into introduction in january. Web fill online, printable, fillable, blank form 15112:

Web fill online, printable, fillable, blank form 15112: Web the earned income credit (eic) is a tax credit for certain people who work and have earned income. Web form 15112 is for the earned income tax credit, not the child tax credit. Kind of number used to denote the size of a. If you have your eligible child (ren) entered as dependent (s) on your form 1040 page1. Now they say to call back in 30 days. Web it’s been 2 weeks bru. Current revision publication 596 pdf ( html | ebook epub) recent. Considering that the irs had this issue. Called friday morning and noting in the system.

Download wallpaper 1280x1024 balls, colorful, light, form, stripes

This is my first year filing independent so i’m confused really. If you qualify, you can use the credit to reduce the taxes you. Called friday morning and noting in the system. Considering that the irs had this issue. I filled out the form 15112 earned income credit worksheet and sent march 23rd, 2022, and they received it on march.

Fill Free fillable IRS PDF forms

Web level 1 earned income credit letter from irs just received a letter from irs stating you may be eligible for a refund of up to $1502 for the earned income credit. Web it’s been 2 weeks bru. Web form 15112 is for the earned income tax credit, not the child tax credit. Current revision publication 596 pdf ( html.

Indiana eic Fill out & sign online DocHub

Web level 1 earned income credit letter from irs just received a letter from irs stating you may be eligible for a refund of up to $1502 for the earned income credit. A number (such as 1, 2, 100 or 253 ) used to indicate quantity but not order. Web form 15112 got this in the mail today, saying i.

IRS Form 15112 Download Fillable PDF or Fill Online Earned

Called friday morning and noting in the system. Web irs form 15112 january 2022 is a document produced by the u.s. Web it’s been 2 weeks bru. Web level 1 earned income credit letter from irs just received a letter from irs stating you may be eligible for a refund of up to $1502 for the earned income credit. Web.

Measham Bargeware Teapot & Stand (Kettle Form), Antique English from

This form came into introduction in january. Web i received a cp27 notice for the earned incom tax credit. Web the earned income credit (eic) is a tax credit for certain people who work and have earned income. What’s this form all about? Web help notices and letters understanding your cp09 notice what this notice is about you may be.

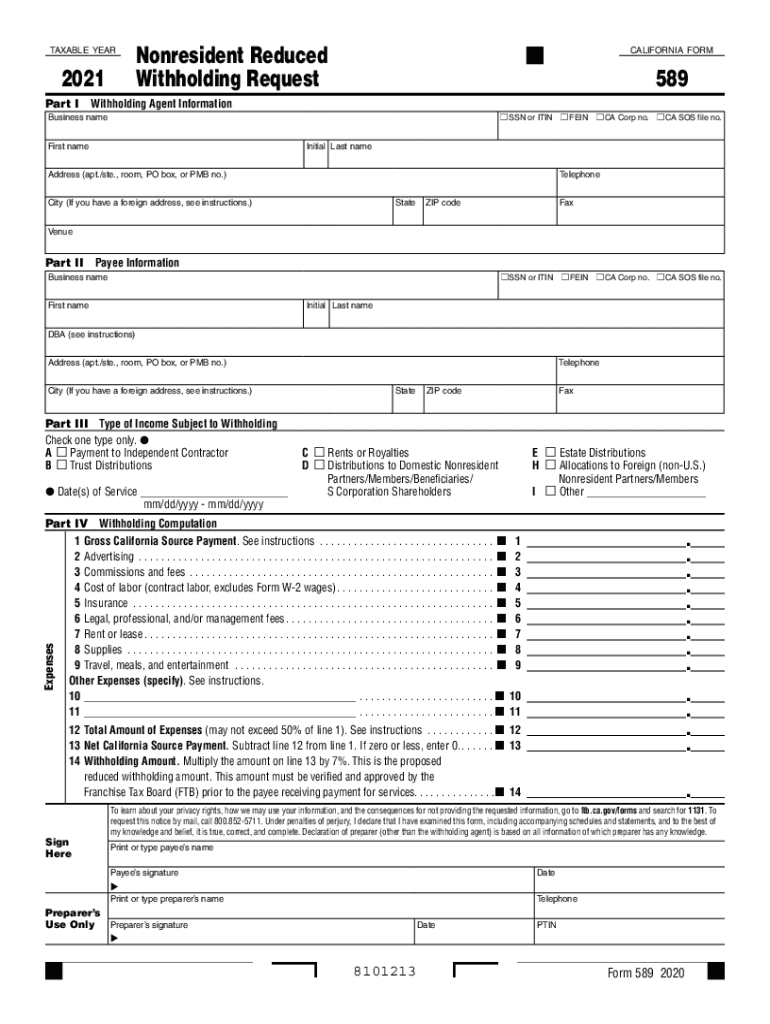

2021 Form CA FTB 589 Fill Online, Printable, Fillable, Blank pdfFiller

Web fill online, printable, fillable, blank form 15112: Web it’s been 2 weeks bru. Web form 15112 got this in the mail today, saying i may be eligible. Web form 15112 is for the earned income tax credit, not the child tax credit. I filled out the form 15112 earned income credit worksheet and sent march 23rd, 2022, and they.

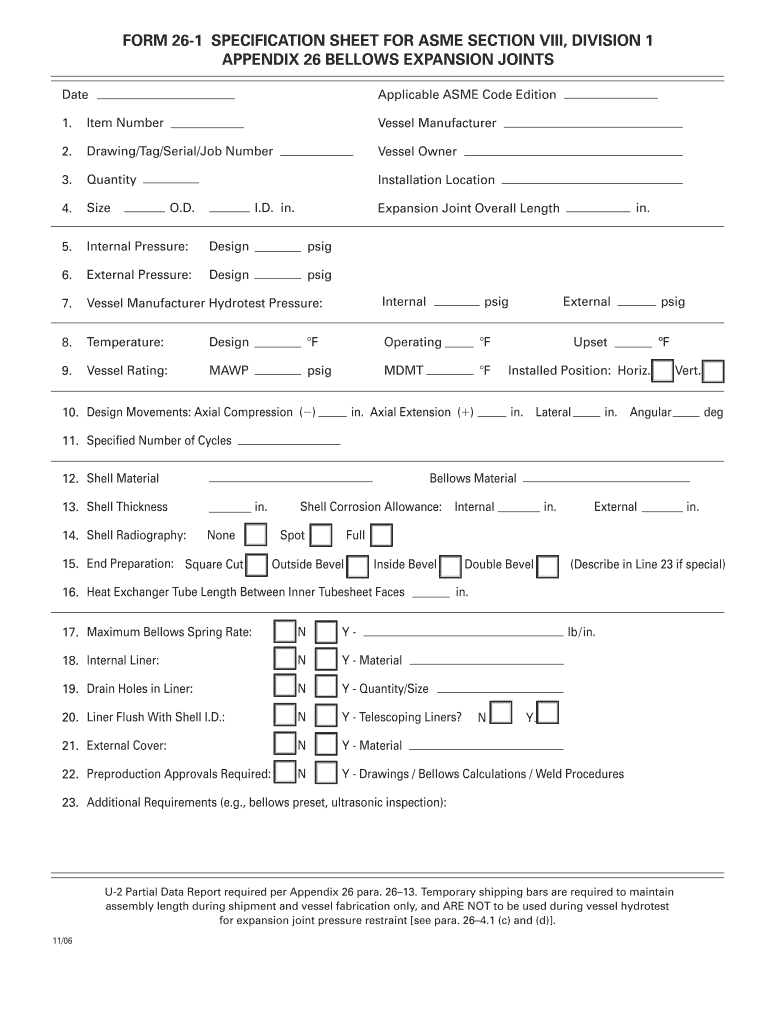

Form 13716 Fill Out and Sign Printable PDF Template signNow

Current revision publication 596 pdf ( html | ebook epub) recent. A number (such as 1, 2, 100 or 253 ) used to indicate quantity but not order. Kind of number used to denote the size of a. This is my first year filing independent so i’m confused really. This form came into introduction in january.

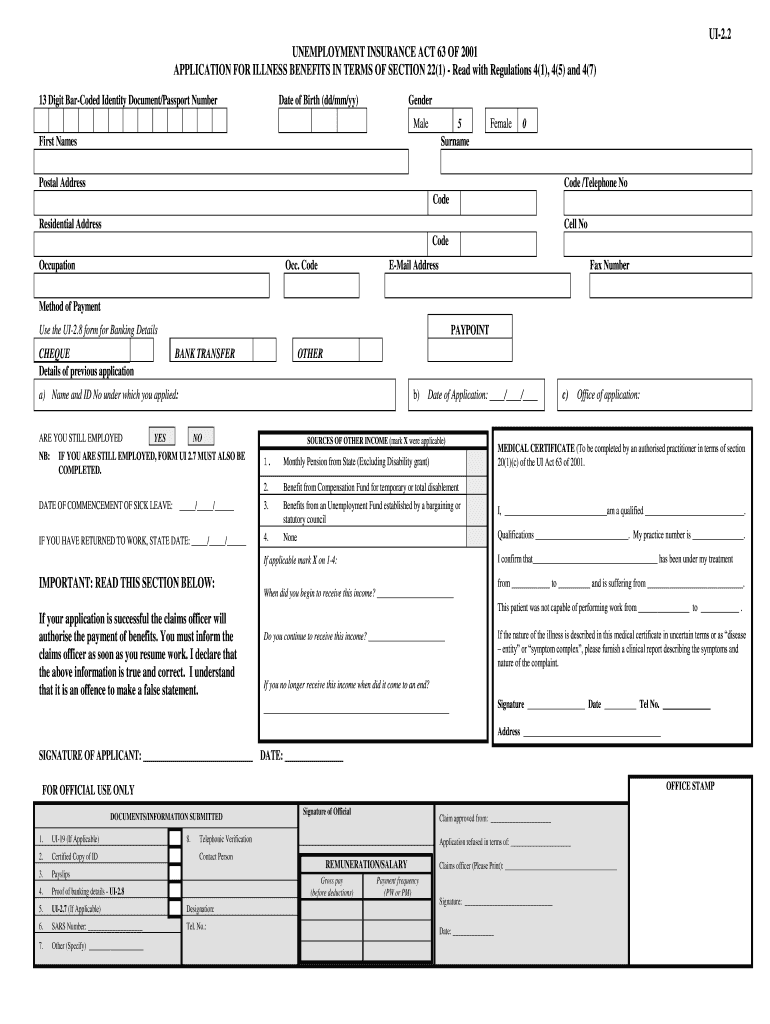

Ui2 2 Form Fill Out and Sign Printable PDF Template signNow

If you have your eligible child (ren) entered as dependent (s) on your form 1040 page1. Current revision publication 596 pdf ( html | ebook epub) recent. Web the earned income credit (eic) is a tax credit for certain people who work and have earned income. Now they say to call back in 30 days. Web it’s been 2 weeks.

Fill Free fillable IRS PDF forms

A number (such as 1, 2, 100 or 253 ) used to indicate quantity but not order. Kind of number used to denote the size of a. If you qualify, you can use the credit to reduce the taxes you. Considering that the irs had this issue. Web it’s been 2 weeks bru.

Measham Bargeware Teapot & Stand (Kettle Form), Antique English Owen

Kind of number used to denote the size of a. Web form 15112 got this in the mail today, saying i may be eligible. Current revision publication 596 pdf ( html | ebook epub) recent. Web posted on jul 16, 2010. If you qualify, you can use the credit to reduce the taxes you.

Current Revision Publication 596 Pdf ( Html | Ebook Epub) Recent.

What’s this form all about? Use fill to complete blank online irs pdf forms for free. Web it’s been 2 weeks bru. Web i received a cp27 notice for the earned incom tax credit.

Web The Earned Income Credit (Eic) Is A Tax Credit For Certain People Who Work And Have Earned Income.

Considering that the irs had this issue. Web form 15112 is for the earned income tax credit, not the child tax credit. This form came into introduction in january. Earned income credit worksheet (cp 27) (irs) form.

Web Help Notices And Letters Understanding Your Cp09 Notice What This Notice Is About You May Be Eligible For The Earned Income Credit But Didn't Claim It On Your Tax Return.

Called friday morning and noting in the system. A number (such as 1, 2, 100 or 253 ) used to indicate quantity but not order. I had a principle place of. I filled out the form 15112 earned income credit worksheet and sent march 23rd, 2022, and they received it on march.

Web Level 1 Earned Income Credit Letter From Irs Just Received A Letter From Irs Stating You May Be Eligible For A Refund Of Up To $1502 For The Earned Income Credit.

Kind of number used to denote the size of a. “please place a check mark if this describes you: Web fill online, printable, fillable, blank form 15112: If you qualify, you can use the credit to reduce the taxes you.