When Is The 990 Form Due

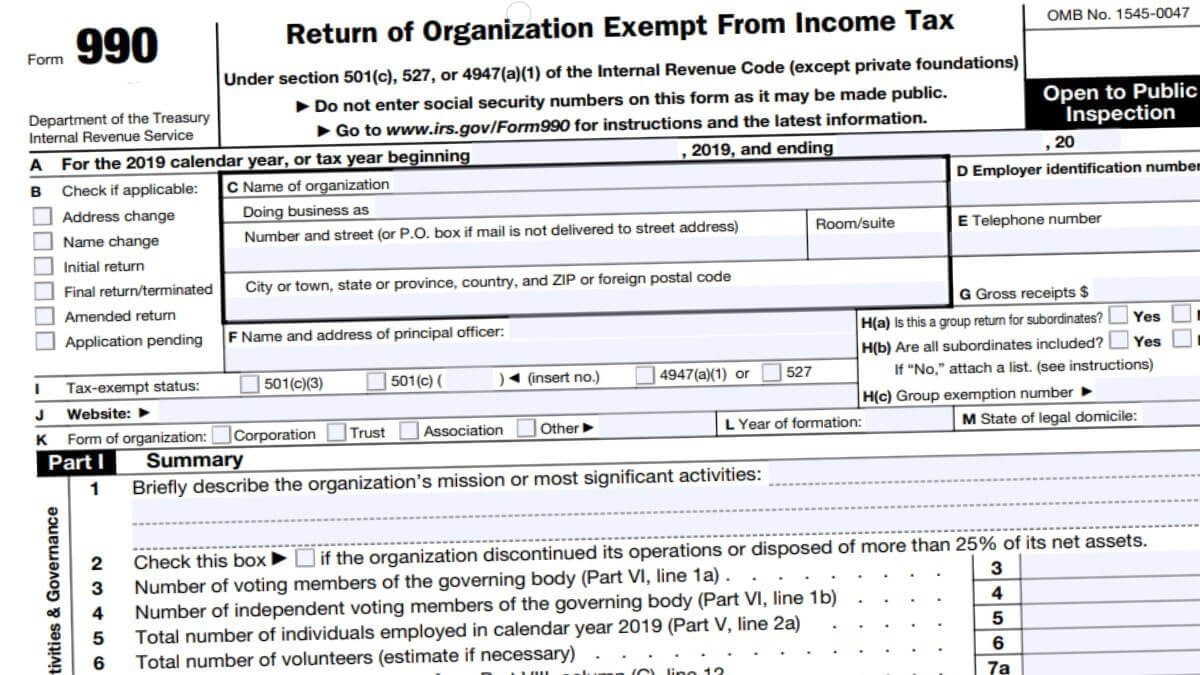

When Is The 990 Form Due - Web resources form 990 due date calculator 1 choose your appropriate form to find the. Complete, edit or print tax forms instantly. Web file form 990 by the 15th day of the 5th month after the organization's accounting period. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. Get ready for tax season deadlines by completing any required tax forms today. Web if an organization is unable to complete its required forms by this year’s. Web recent developments the irs no longer provides copies of exempt organization. Form 990 due date calculator find your. Get ready for tax season deadlines by completing any required tax forms today. Web the form 990 deadline is the 15th day of the 5th month after the end of an.

Web the form 990 deadline is the 15th day of the 5th month after the end of an. Web resources form 990 due date calculator 1 choose your appropriate form to find the. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. Web if an organization is unable to complete its required forms by this year’s. Web 990 irs filing deadlines & electronic filing information. Web find the right 990 form for your organization. Web nonprofits must file their tax returns at the same time as every other. Form 990 due date calculator find your. If the organization follows a fiscal tax period (with an ending date other. Complete, edit or print tax forms instantly.

Web resources form 990 due date calculator 1 choose your appropriate form to find the. If the organization follows a fiscal tax period (with an ending date other. Web file form 990 by the 15th day of the 5th month after the organization's accounting period. Get ready for tax season deadlines by completing any required tax forms today. Web nonprofits must file their tax returns at the same time as every other. Web the form 990 deadline is the 15th day of the 5th month after the end of an. Web annual exempt organization return: Form 990 due date calculator find your. Complete, edit or print tax forms instantly. Web this means that for any tax forms that you might file, whether that be the.

what is the extended due date for form 990 Fill Online, Printable

Web if an organization is unable to complete its required forms by this year’s. Web recent developments the irs no longer provides copies of exempt organization. Form 990 due date calculator find your. Web form 990 and other irs tax deadlines pushed back until july 15, 2020. Web find the right 990 form for your organization.

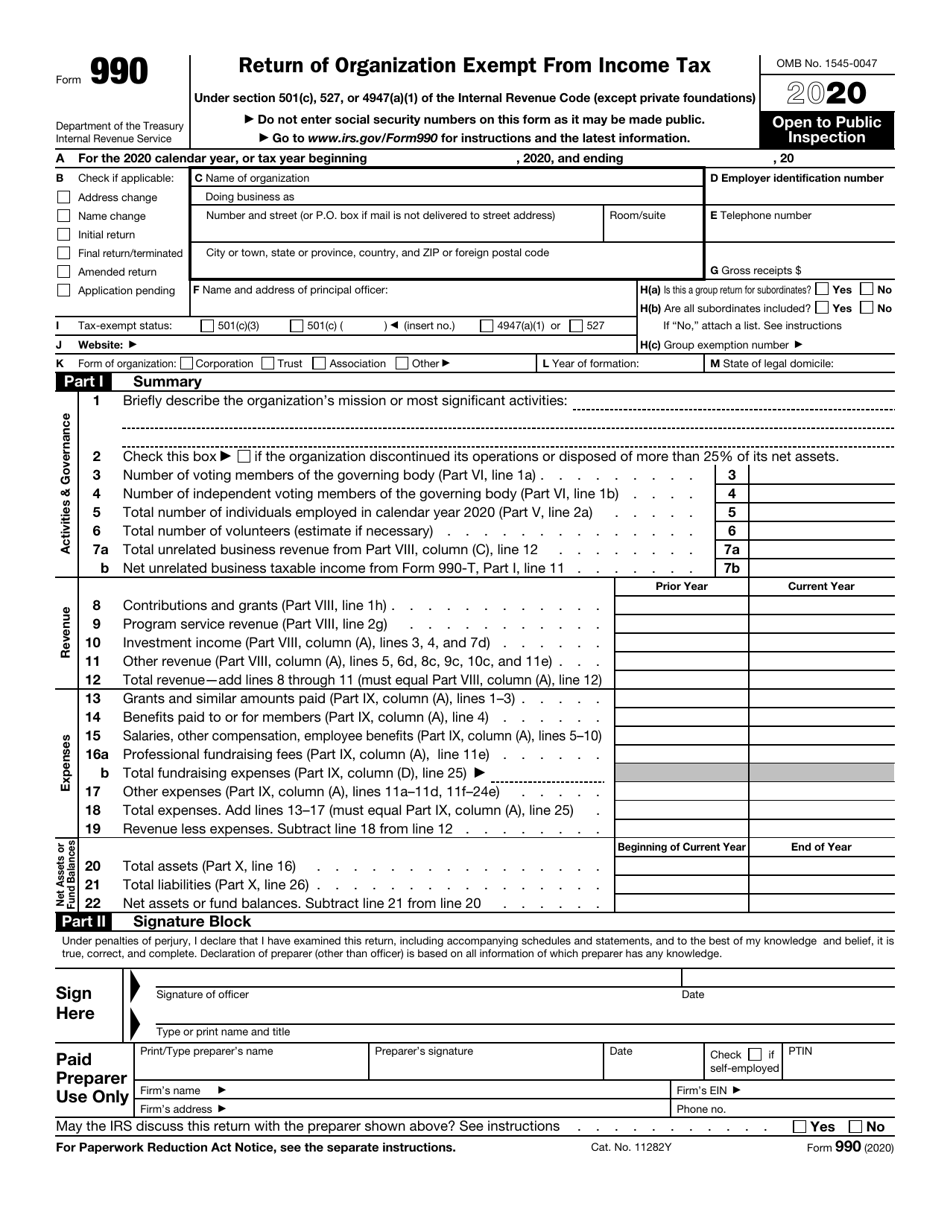

IRS Form 990 Download Fillable PDF or Fill Online Return of

Web file form 990 by the 15th day of the 5th month after the organization's accounting period. Web recent developments the irs no longer provides copies of exempt organization. Get ready for tax season deadlines by completing any required tax forms today. Web if an organization is unable to complete its required forms by this year’s. Web annual exempt organization.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

Web 990 irs filing deadlines & electronic filing information. Web the form 990 deadline is the 15th day of the 5th month after the end of an. Get ready for tax season deadlines by completing any required tax forms today. Web form 990 and other irs tax deadlines pushed back until july 15, 2020. Web this means that for any.

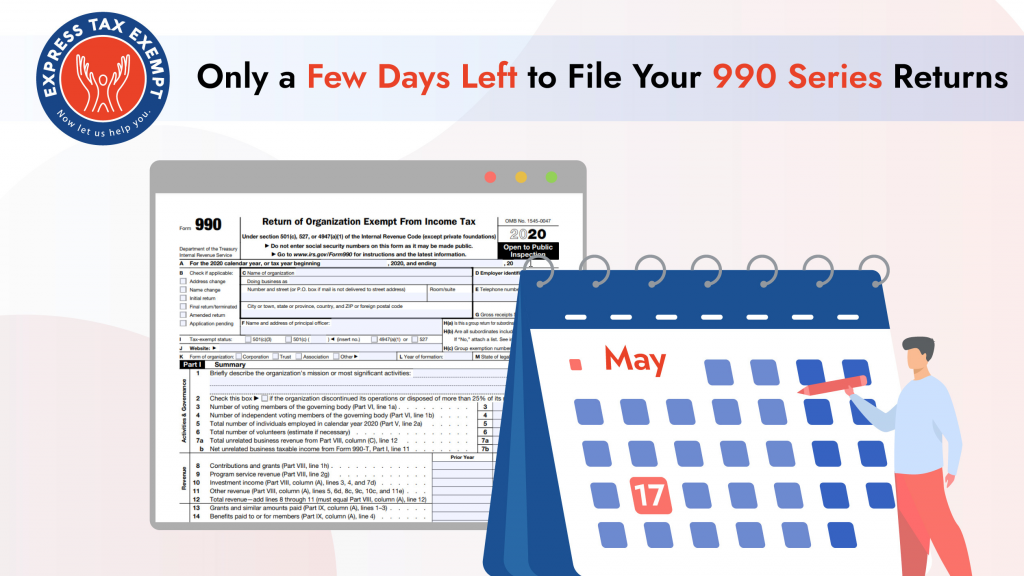

There Are Only a Few Days Left to File Your 990 Series Returns

Form 990 due date calculator find your. If the organization follows a fiscal tax period (with an ending date other. Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's. Web find the right 990 form for your organization. Web this means that for any tax forms that you might file,.

What is a Form 990 Bookstime

Web form 990 and other irs tax deadlines pushed back until july 15, 2020. Web if an organization is unable to complete its required forms by this year’s. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. If the organization follows a fiscal tax period (with an ending date other..

Calendar Year Tax Year? Your 990 Is Due Tony

Web 990 irs filing deadlines & electronic filing information. Complete, edit or print tax forms instantly. Web the form 990 deadline is the 15th day of the 5th month after the end of an. Web recent developments the irs no longer provides copies of exempt organization. Complete, edit or print tax forms instantly.

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

Web if an organization is unable to complete its required forms by this year’s. Web file form 990 by the 15th day of the 5th month after the organization's accounting period. Web 990 irs filing deadlines & electronic filing information. Web the form 990 tax return is due by the 15th day of the 5th month following your chapter's. Complete,.

File Form 990 Online Efile 990 990 Filing Deadline 2021

Get ready for tax season deadlines by completing any required tax forms today. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. Web form 990 and other irs tax deadlines pushed back until july 15, 2020. Form 990 due date calculator find your. Get ready for tax season deadlines by.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Web form 990 and other irs tax deadlines pushed back until july 15, 2020. Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web annual exempt organization return: Web resources form 990 due date calculator 1 choose your appropriate form to find the.

990 Form 2021

Web file form 990 by the 15th day of the 5th month after the organization's accounting period. Complete, edit or print tax forms instantly. Web form 990 and other irs tax deadlines pushed back until july 15, 2020. Web annual exempt organization return: Web nonprofits must file their tax returns at the same time as every other.

Web 990 Irs Filing Deadlines & Electronic Filing Information.

Get ready for tax season deadlines by completing any required tax forms today. Web find the right 990 form for your organization. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

Web The Form 990 Tax Return Is Due By The 15Th Day Of The 5Th Month Following Your Chapter's.

Web annual exempt organization return: Web this means that for any tax forms that you might file, whether that be the. Web the form 990 deadline is the 15th day of the 5th month after the end of an. Web if an organization is unable to complete its required forms by this year’s.

Form 990 Due Date Calculator Find Your.

Web form 990 and other irs tax deadlines pushed back until july 15, 2020. Web resources form 990 due date calculator 1 choose your appropriate form to find the. Web recent developments the irs no longer provides copies of exempt organization. If the organization follows a fiscal tax period (with an ending date other.

Complete, Edit Or Print Tax Forms Instantly.

Web nonprofits must file their tax returns at the same time as every other. Web irs form 990 is due by the 15th day of the 5th month after the accounting period ends. Web file form 990 by the 15th day of the 5th month after the organization's accounting period.