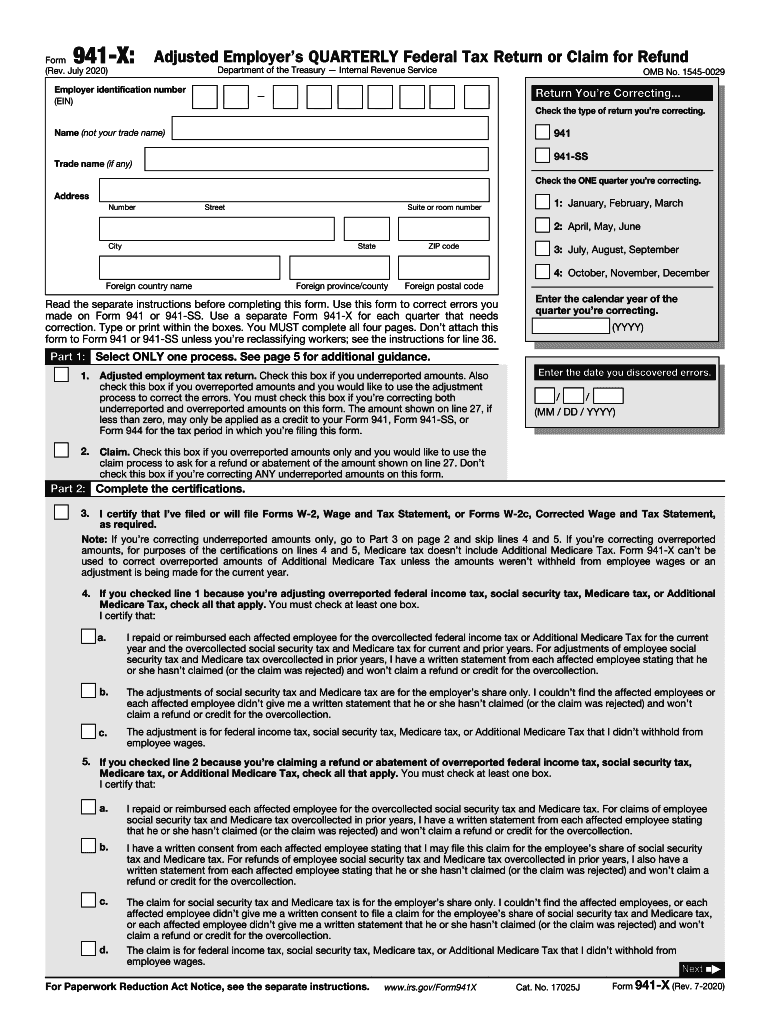

2020 Form 941X

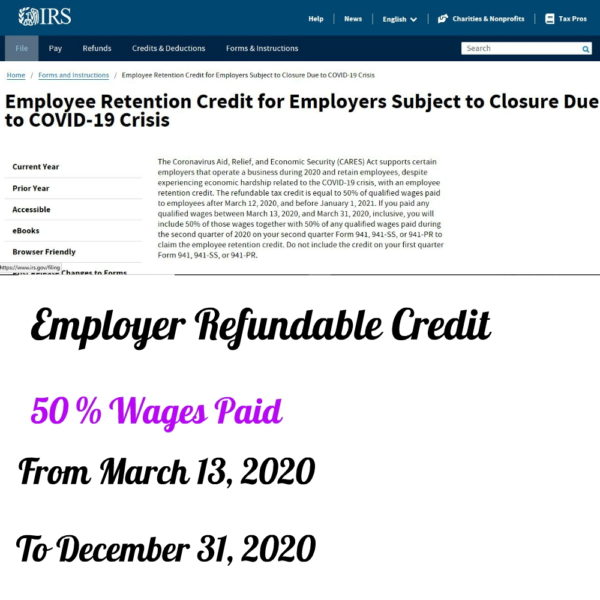

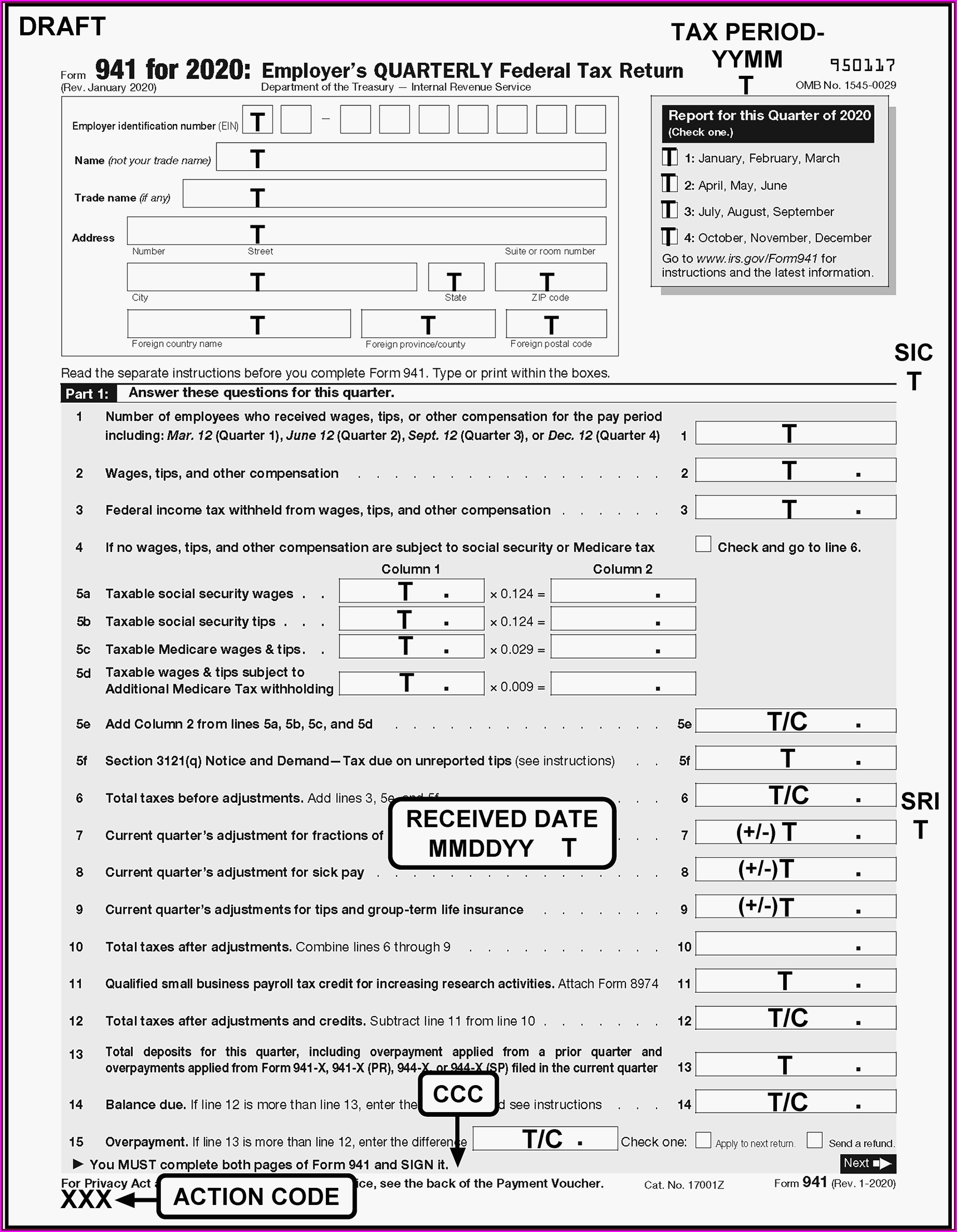

2020 Form 941X - Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. If you are located in. Adjusted employer's quarterly federal tax return or claim for refund keywords: January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020;

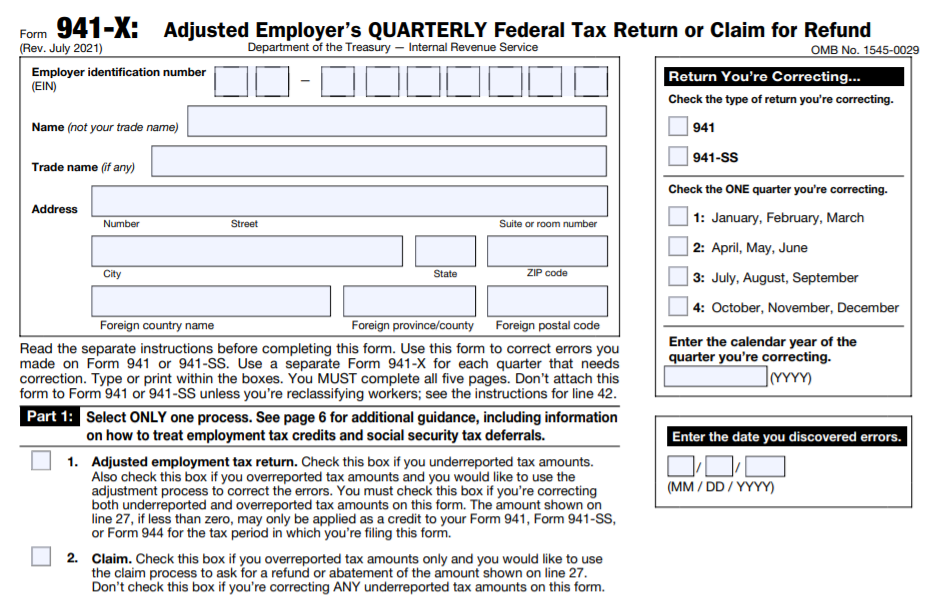

April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. If you are located in. Adjusted employer's quarterly federal tax return or claim for refund keywords: January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

If you are located in. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020. Adjusted employer's quarterly federal tax return or claim for refund keywords: Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no.

941x Fill out & sign online DocHub

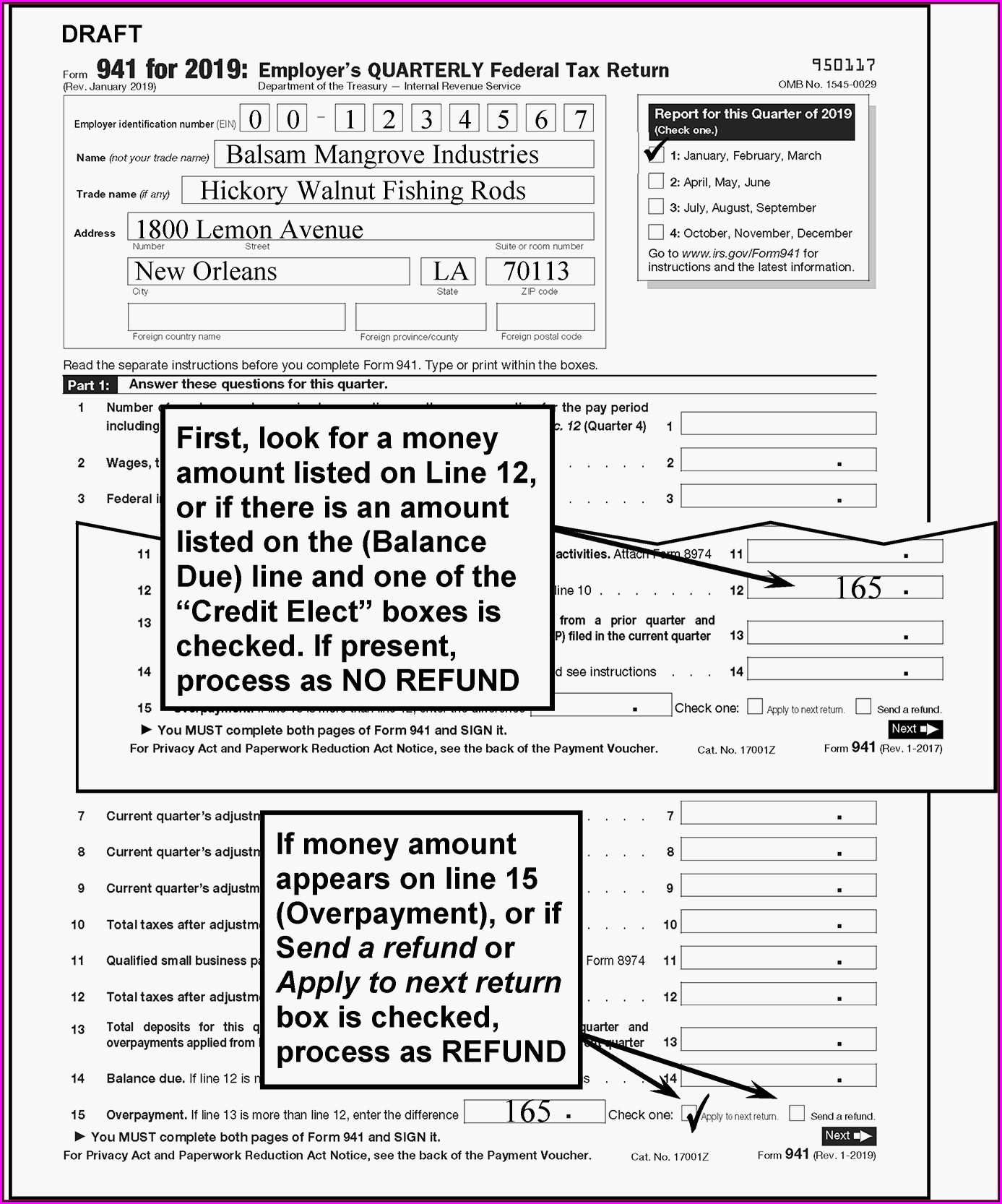

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Therefore, you may need to amend your income tax return (for example,.

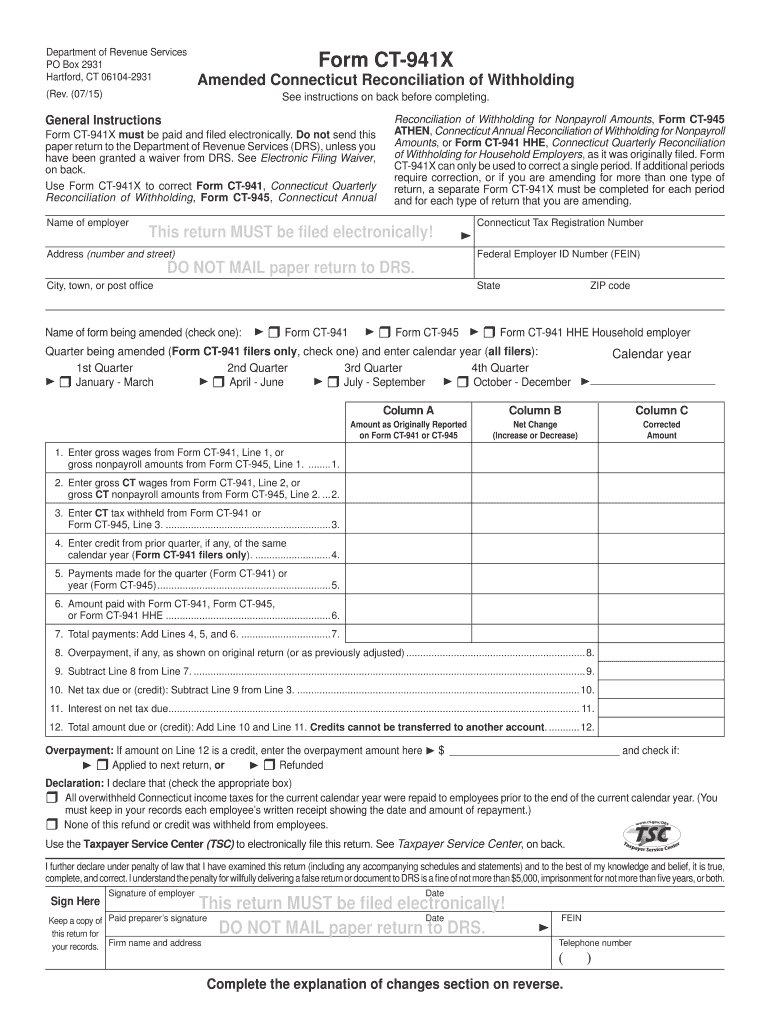

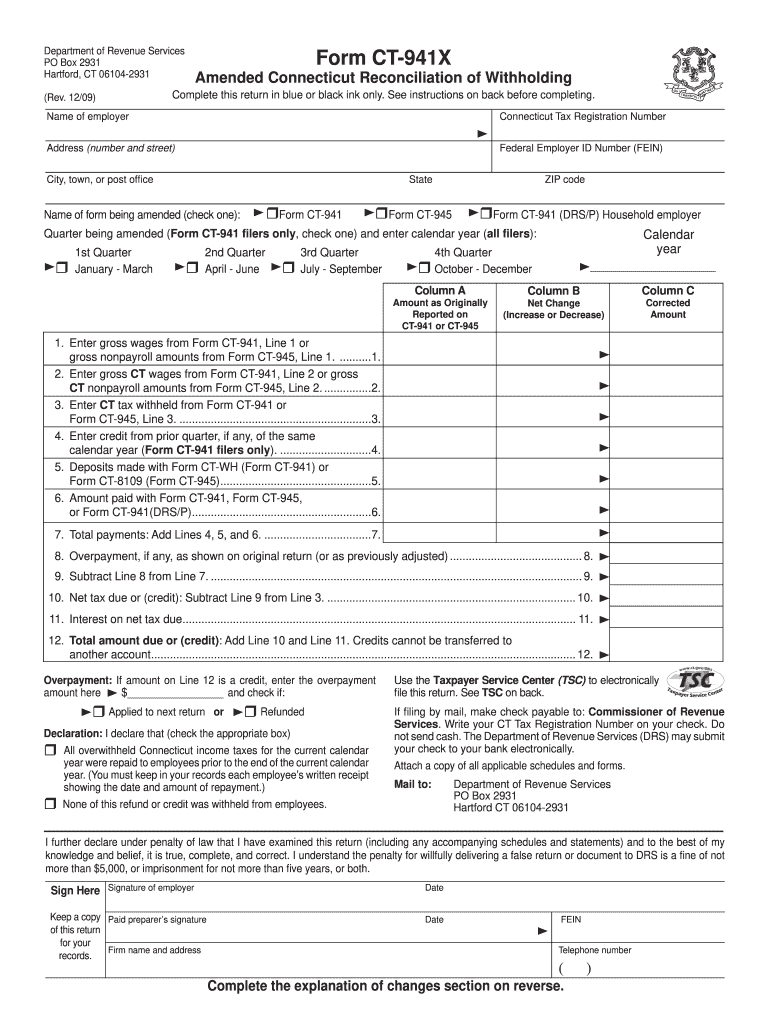

Ct 941 Hhe Fill Out and Sign Printable PDF Template signNow

Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020. April 2023) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, you may need to amend.

Irs.gov Form 941x Form Resume Examples yKVBjnRVMB

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Web the employee retention credit for wages paid.

Worksheet 2 941x

Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. April 2023) adjusted employer’s quarterly federal.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; Adjusted employer's quarterly federal.

2020 Form 941 Employee Retention Credit for Employers subject to

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Therefore, you may need to amend your income tax return (for example, forms 1040, 1065, 1120, etc.) to reflect that reduced deduction. If you are located in. April 2023) adjusted employer’s quarterly federal tax return or claim for.

Irs.gov Form 941 X Instructions Form Resume Examples 1ZV8dX3V3X

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter.

Ct Form 941 X Fill Out and Sign Printable PDF Template signNow

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter.

7 Awesome Reasons To File Your Form 941 With TaxBandits Blog TaxBandits

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Adjusted employer's quarterly federal tax return or claim for refund keywords: Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020,.

Simple Form 941X 2018 Fill Out and Sign Printable PDF Template signNow

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020; January 2020) employer’s quarterly.

April 2023) Adjusted Employer’s Quarterly Federal Tax Return Or Claim For Refund Department Of The Treasury — Internal Revenue Service Omb No.

July 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Adjusted employer's quarterly federal tax return or claim for refund keywords: Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine, maryland, massachusetts, michigan, new hampshire, new jersey, new york, north carolina, ohio, pennsylvania, rhode island, south carolina, tennessee, vermont,. Therefore, any corrections to the employee retention credit for the period from march 13, 2020, through march 31, 2020, should be reported on form 941‐x filed for the second quarter of 2020.

Therefore, You May Need To Amend Your Income Tax Return (For Example, Forms 1040, 1065, 1120, Etc.) To Reflect That Reduced Deduction.

If you are located in. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Web the employee retention credit for wages paid march 13, 2020, through march 31, 2020, is claimed on form 941 for the second quarter of 2020;