Form 3520 Deadline

Form 3520 Deadline - Owner, is march 15, and the due date for. It does not have to be a “foreign gift.” rather, if a. If a person files an. Person’s form 3520 is due on the 15th day of the 4th month following the end of. Web form 3520 filing requirements. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of. A calendar year trust is due march 15. Web what is the filing deadline for form 3520? Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

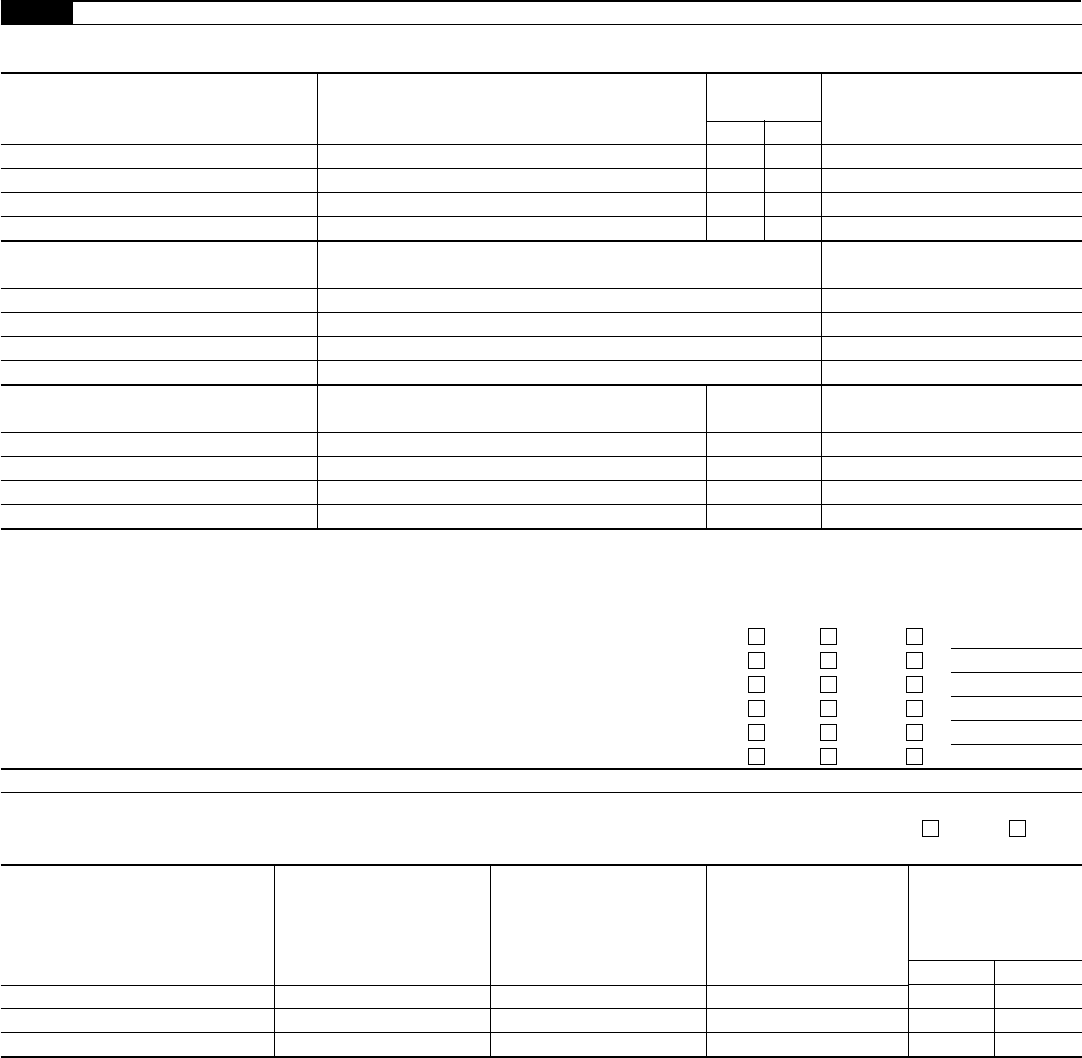

Web what is the filing deadline for form 3520? Web form 3520 & instructions: Owner, is march 15, and the due date for. Web form 3520 filing requirements. Web form 3520 filing requirements. Web go to www.irs.gov/form3520a for instructions and the latest information omb no. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. As provided by the irs: Get ready for tax season deadlines by completing any required tax forms today. Talk to our skilled attorneys by scheduling a free consultation today.

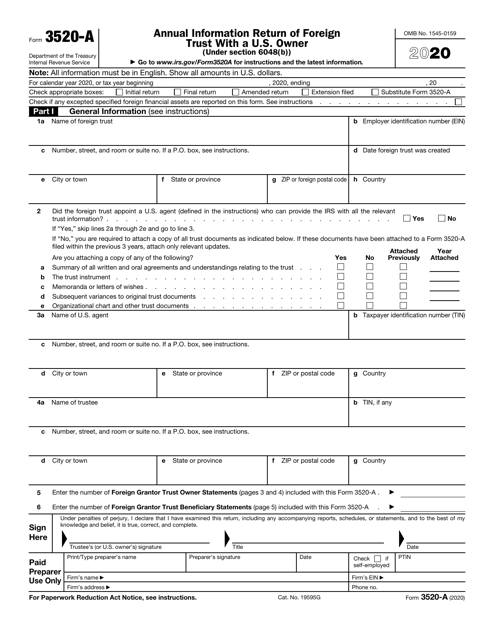

If you have reportable activities, it’s important to remember irs form 3520 is due at the same time as your annual tax return. Web form 3520 & instructions: If a person files an. All information must be in english. Form 3520 is technically referred to as the annual return to report transactions with foreign trusts and receipt of certain foreign. Web the deadline to file form 3520 is the same as the deadline for filing an ordinary tax return (1040) — although the deadline to file form 3520a is different. As provided by the irs: Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Form 3520 is used to report certain transactions involving foreign trusts, including the creation of a foreign trust, the transfer of property to a foreign.

The Tax Times Foreign Trust Form 3520A Filing Date Reminder & Tips To

Form 3520 is used to report certain transactions involving foreign trusts, including the creation of a foreign trust, the transfer of property to a foreign. If you have reportable activities, it’s important to remember irs form 3520 is due at the same time as your annual tax return. Get ready for tax season deadlines by completing any required tax forms.

IRS 3520 A FILING DEADLINE FAST APPROACHING Southpac Group

Talk to our skilled attorneys by scheduling a free consultation today. Get ready for tax season deadlines by completing any required tax forms today. Web the deadline to file form 3520 is the same as the deadline for filing an ordinary tax return (1040) — although the deadline to file form 3520a is different. As provided by the irs: Person’s.

March 15 Tax Deadline is Here Esquire Group

If you have reportable activities, it’s important to remember irs form 3520 is due at the same time as your annual tax return. Web the deadline to file form 3520 is the same as the deadline for filing an ordinary tax return (1040) — although the deadline to file form 3520a is different. It does not have to be a.

2020 Form IRS 3520 Fill Online, Printable, Fillable, Blank pdfFiller

Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of. Form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain. It does not have to.

question about form 3520 TurboTax Support

A calendar year trust is due march 15. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Complete, edit or print tax forms instantly. Web go to www.irs.gov/form3520a for instructions and the latest information omb no. Get ready for tax season deadlines by completing any required tax forms today.

Form 3520 Blank Sample to Fill out Online in PDF

If you have reportable activities, it’s important to remember irs form 3520 is due at the same time as your annual tax return. All information must be in english. It does not have to be a “foreign gift.” rather, if a. Form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Send form 3520 to the. All information must be in english. Talk to our skilled attorneys by scheduling a free consultation today. Show all amounts in u.s. Web due date for filing form 3520/3520a.

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

If you have reportable activities, it’s important to remember irs form 3520 is due at the same time as your annual tax return. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. A calendar year trust is due march 15. Get ready for tax season deadlines by completing any.

Fillable Form 3520 Annual Return To Report Transactions With Foreign

Web due date for filing form 3520/3520a. Show all amounts in u.s. Form 3520 “[i]n general, a u.s. Web form 3520 filing requirements. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Form 3520 “[i]n general, a u.s. Complete, edit or print tax forms instantly..

If You Have Reportable Activities, It’s Important To Remember Irs Form 3520 Is Due At The Same Time As Your Annual Tax Return.

If a person files an. A calendar year trust is due march 15. Owner, is march 15, and the due date for. Get ready for tax season deadlines by completing any required tax forms today.

It Does Not Have To Be A “Foreign Gift.” Rather, If A.

Web form 3520 filing requirements. Person’s form 3520 is due on the 15th day of the 4th month following the end of. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web form 3520 & instructions:

Show All Amounts In U.s.

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Form 3520 is technically referred to as the a nnual return to report transactions with foreign trusts and receipt of certain. Web the deadline to file form 3520 is the same as the deadline for filing an ordinary tax return (1040) — although the deadline to file form 3520a is different.

All Information Must Be In English.

Web due date for filing form 3520/3520a. Web in particular, late filers of form 3520, “annual return to report transactions with foreign trusts and receipt of certain foreign gifts,” have found it challenging to. Ad don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Talk to our skilled attorneys by scheduling a free consultation today.